Shai Gilgeous-Alexander`s recent four-year supermax extension marked not just a celebration of his exceptional season and a huge pay bump, but also brought him near a historic salary level.

By the final year of his new contract in 2030-31, Gilgeous-Alexander is set to make $79 million. This translates to over $963,000 per game, bringing the league within reach of its first $1 million per game deal.

Even if Gilgeous-Alexander won`t quite reach this specific milestone, the NBA`s highest earners continue to see their paychecks grow substantially. Contrast this with 1979, when former MLB pitcher Nolan Ryan signing the first professional sports contract worth a million dollars per year was front-page news in The New York Times.

Let`s explore the drivers behind these soaring NBA salaries, identify the leading contenders to hit this $1 million per game mark, and consider the broader implications for star pay and the league overall.

Reasons behind skyrocketing superstar salaries

The top tier of NBA salaries has rapidly ascended due to two primary factors: the introduction of the supermax extension (officially known as the `designated veteran extension`) and a consistently rising salary cap.

The 2017 collective bargaining agreement established the supermax contract level. This allows players with seven to eight years of service, who have remained with their original team and met specific performance criteria (like All-NBA selections), to sign extensions starting at 35% of the salary cap. Gilgeous-Alexander is the 14th player to sign such a lucrative agreement.

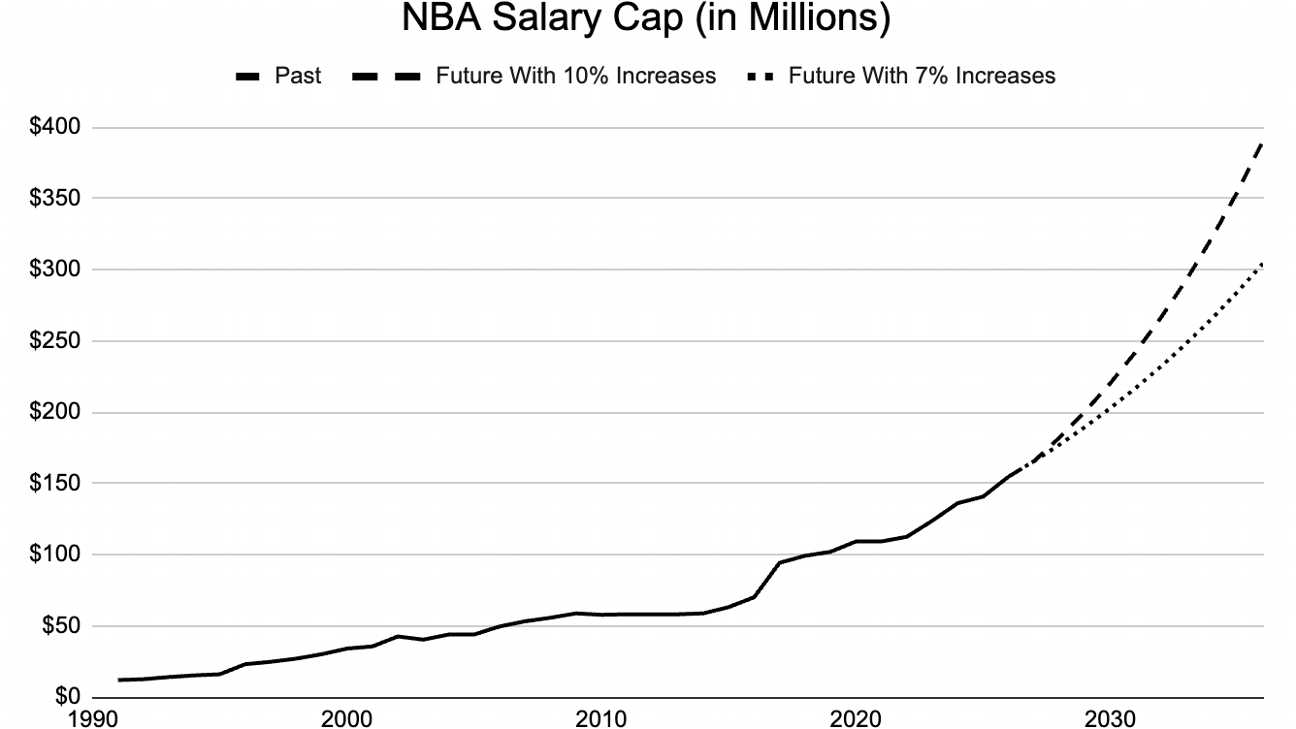

Supermax deals are particularly valuable due to “basketball inflation,” where salary growth significantly outpaces general economic inflation. A decade ago, the salary cap was $63 million, equivalent to roughly $85 million today when adjusted for national inflation. However, the actual 2024-25 salary cap reached $141 million, a roughly two-thirds increase beyond inflation expectations.

These combined trends have propelled the sport`s largest salaries upward at an unprecedented rate. This trajectory is set to continue accelerating as the league`s new television rights deal takes effect next season, injecting a massive amount of new revenue.

Last summer, the NBA and its broadcasting partners finalized an 11-year agreement valued at $76 billion, averaging nearly $7 billion annually. In comparison, the previous TV contract, which concluded after the 2024-25 Finals, was worth $24 billion over nine years, averaging about $2.7 billion per season.

Put simply, the new national media deal will provide the NBA with roughly 2.6 times the annual revenue compared to the previous one.

This large influx of cash will profoundly impact the salary cap and, consequently, the supermax thresholds. Following the last major increase in national TV money, the salary cap jumped by 34% in a single offseason, enabling the Golden State Warriors to sign Kevin Durant. To avoid such dramatic swings, the new CBA includes “cap smoothing” provisions, limiting maximum salary cap increases to 10% per season.

Indeed, the salary cap will rise by 10% next season, increasing the starting supermax salary by the same percentage. However, the NBA anticipates a smaller 7% increase in 2026-27, partly due to declining local TV revenue streams from regional sports networks.

Even if not as abrupt as a 34% leap, consistent annual increases of 7% or 10% will accumulate significant league-wide effects over time. Consider this projection: The salary cap will exceed $150 million for the first time next season and could potentially double to over $300 million by 2033-34. This illustrates the powerful effect of compound growth.

The resulting impact on supermax salaries is remarkable. When Stephen Curry signed the initial supermax contract for the 2017-18 season, the cap was $99 million, meaning his 35% deal began at $34.7 million.

It took five years for the supermax value to cross the $40 million mark. But the pace accelerated as the salary cap climbed: another three years to surpass $50 million, a projected two more years to reach $60 million, and only one additional projected year to exceed $70 million.

Higher starting salaries also mean larger annual raises throughout a supermax deal. The following table shows projected starting and ending salaries for upcoming four-year supermax classes, assuming a maximal scenario of 10% annual cap increases after 2026-27. For example, SGA`s contract will start at $63.7 million in 2027-28 and reach $79 million by Year 4. Players signing a supermax after him are projected to exceed the $82 million ($1 million per game) mark by the end of their deals.

| Starting Season | In Year 1 ($M) | By Year 4 ($M) |

|---|---|---|

| 2026-27 | 57.9 | 71.8 |

| 2027-28 | 63.7 | 79.0 |

| 2028-29 | 70.1 | 86.9 |

| 2029-30 | 77.1 | 95.6 |

| 2030-31 | 84.8 | 105.1 |

| 2031-32 | 93.3 | 115.7 |

| 2032-33 | 102.6 | 127.2 |

This table relies on certain assumptions: first, that the supermax structure remains unchanged after the CBA potentially expires later this decade; and second, that the league returns to 10% annual salary cap increases after 2026-27. The latter might be optimistic. Here is the same projection using a more conservative assumption of 7% annual increases instead.

| Starting Season | In Year 1 ($M) | By Year 4 ($M) |

|---|---|---|

| 2026-27 | 57.9 | 71.8 |

| 2027-28 | 62.0 | 76.8 |

| 2028-29 | 66.3 | 82.2 |

| 2029-30 | 70.9 | 88.0 |

| 2030-31 | 75.9 | 94.1 |

| 2031-32 | 81.2 | 100.7 |

| 2032-33 | 86.9 | 107.8 |

Top candidates to reach $1 million per game

Based on these projections, the most likely candidates to first achieve a $1 million per game salary are players who will sign supermax deals after Gilgeous-Alexander, who was part of the 2018 draft class.

Among the 2019 draft class, Ja Morant is the only player with an All-NBA selection, which occurred three years ago. It seems improbable that any other player from this draft class will now qualify for a supermax.

However, the 2020 draft class features two prime contenders for supermax eligibility: Anthony Edwards and Tyrese Haliburton. Haliburton`s situation is uncertain as he is expected to miss all of next season due to an Achilles injury. Edwards, though, has earned back-to-back All-NBA second-team honors, positioning him for a potential supermax in the summer of 2027. Such a deal could be worth up to four years and $345 million, potentially exceeding $82 million annually by its second year.

If Edwards doesn`t get there first, two players from the 2021 draft class earned their inaugural All-NBA selections last season: Cade Cunningham and Evan Mobley. Other notable prospects from that draft year include Scottie Barnes, Alperen Sengun, and Franz Wagner.

Assuming even modest annual cap increases between now and the 2030s, it`s highly probable that whoever among Cunningham, Mobley, or their contemporaries qualifies for the supermax will earn over $1 million per game at some point during the contract.

As the salary cap continues its ascent, more and more young talents will be positioned to secure unprecedented earnings on the court. Recent draft picks, including Jalen Williams, Chet Holmgren, and Paolo Banchero from the 2022 class, and Victor Wembanyama and Amen Thompson from the 2023 class, could realistically sign contracts exceeding $100 million per year.

Experienced veterans signing shorter extensions could also command nine-figure annual salaries. This includes Gilgeous-Alexander himself, when he is eligible for another lucrative extension after his current supermax concludes in 2031. Just recently, Devin Booker of the Phoenix Suns agreed to a two-year extension worth up to $145 million, which boasts a higher average annual value than SGA`s recently signed supermax (though SGA`s longer deal will reach a higher peak salary by its end).

NBA following other leagues

While a player earning a million dollars per game would be a first in basketball, other sports have already seen athletes surpass this figure.

In the early 2020s, Major League Baseball pitchers like Gerrit Cole and Justin Verlander began earning over $35 million per season, which translates to more than $1 million per game over roughly 32 starts. This comparison offers a relevant parallel for the NBA. Public analytics models suggest that the top basketball players contribute around 20 wins per season, effectively one win every four games. Similarly, elite baseball pitchers are valued at about eight wins above replacement annually, also approximating one win in every four games.

While not a perfect one-to-one comparison, the impact of the best NBA players on a single game`s outcome is comparable to that of an MLB ace on the mound. Therefore, it logically follows that their salaries would trend similarly.

Some leagues compensate their players even more generously. According to Spotrac, 84 NFL players have cap hits of $17 million or higher this season, meaning they earn at least $1 million per game across a 17-game schedule. The league`s top quarterbacks can command nearly $3 million per game, which makes sense given their immense influence on game results, the shorter schedule`s impact, and the NFL`s status as the wealthiest sports league in the United States.

The most extreme examples are elite soccer players recruited by the Saudi Pro League with extraordinarily high offers. Cristiano Ronaldo, for instance, is reportedly earning around $200 million per year.

However, among major team sports not funded by sovereign wealth, the NBA is distinct in its combination of high per-game pay and player participation volume. Unlike MLB pitchers or NFL stars who play only a fraction of the games their NBA counterparts do, even if per-game rates are higher elsewhere, the NBA`s supermax elite can achieve significantly higher total compensation over a season due to the 82-game schedule.

Consider this statistic: Next season, 15 NBA players are projected to have cap hits of $50 million or more, according to Spotrac. The NFL, NHL, and MLB combined have only two such contracts currently: New York Mets outfielder Juan Soto and Dallas Cowboys quarterback Dak Prescott.

Ripple effects of a soaring salary cap

As star salaries continue their rapid rise, several potential ripple effects could emerge within the NBA. For example, “load management” could become an even more contentious issue, with less tolerance for highly paid players sitting out games. Criticisms like, “You`re earning over a million dollars tonight, why aren`t you playing?!” could become more common.

Higher salaries might also influence player transaction decisions. Some NBA stars might begin to prioritize factors other than maximum money when making career choices. While maximizing earnings is a natural desire for competitive athletes, serving as both a status symbol and a financial windfall, as the numbers climb higher, the practical difference in quality of life between earning $75 million or $85 million per year might diminish.

If the financial difference becomes less significant, stars might feel more inclined to explore the free agent market rather than automatically re-signing with the team that can offer the supermax, secure in the knowledge that they will achieve substantial generational wealth regardless. Others might potentially choose to sign for less than the maximum allowable amount to help their team retain teammates who would otherwise exceed the restrictive second salary apron.

Finally, even if player salaries maintain a consistent percentage of the salary cap, the sheer size of the numbers could become so large that they spark new debates about whether NBA stars are “overpaid.” Yet, here`s the reality: based on value creation, a player like SGA is arguably already worth nine figures annually, even before his contract reaches that level.

Will superstars be worth $1 million per game?

Last season, NBA teams spent approximately $5.65 billion on salaries and luxury tax payments, according to Spotrac data. With 1,230 regular-season wins available, this equates to an average cost of about $4.6 million per win. (There are complex arguments about adjusting for minimum salaries or replacement levels to find the `true` cost per win, but this simple calculation suffices for now, and accounting for those factors would likely make stars appear even *more* valuable.)

Multiplying that cost by Gilgeous-Alexander`s league-leading estimated value of 20.9 wins last season, according to Dunks & Threes, results in a regular-season value of $96 million. This figure doesn`t even include the value he brought by leading his team deep into the playoffs, or the boost to the franchise`s ticket and merchandise sales, or the overall increase in the team`s valuation.

For context, when LeBron James returned to the Cleveland Cavaliers in 2014, Forbes estimated that he “immediately elevate[d] the Cavaliers franchise value by at least $100 million to $150 million.” That value increase would undoubtedly be higher today, accounting for another decade of inflation.

Given the existence of contract maximums and the disproportionate importance of star players in the NBA compared to other sports, the league`s top talents have historically signed contracts below their true market value relative to production. This will likely remain true even at $1 million per game or more. In 2016, ESPN`s Kevin Pelton calculated that considering all factors, “in a world without limits on player salaries, the Cavaliers could easily justify offering James $100 million a year.”

As Pelton noted, that figure was higher than the entire salary cap at the time, similar to how Michael Jordan earned more than the entire Chicago Bulls salary cap in the late 1990s before the NBA implemented maximum contracts. Applying the same valuation methods today would place the value of top superstars well over $150 million annually – nearly double the $1 million per game threshold.

This doesn`t apply to every player on a maximum contract – in a system with fixed caps, some players will outperform their deal while others fall short. But for generational talents like LeBron James, Michael Jordan, or Shai Gilgeous-Alexander – players who genuinely transform franchises and define eras – the conclusion is clear.

A supermax salary reaching $1 million per game won`t merely be a significant milestone when achieved in the coming years. For the league`s absolute elite, it will still represent a considerable bargain.